Top Home Insurance Price

Home insurance is an essential aspect of protecting one's biggest investment: their home. With a myriad of factors influencing the cost of home insurance, understanding the market and its trends is crucial for homeowners. This article aims to delve into the world of home insurance pricing, providing an in-depth analysis of the top factors that influence the cost of coverage and offering expert insights to help homeowners make informed decisions.

The Landscape of Home Insurance Pricing

Home insurance prices are determined by a complex interplay of variables, each contributing to the overall cost of coverage. From geographical location and property value to the coverage options chosen, every aspect plays a role in the final insurance premium. Understanding these factors is the first step towards securing the best possible deal.

Geographical Location: The Impact of Where You Live

One of the most significant influences on home insurance prices is the geographical location of the property. Insurance providers assess the risks associated with a particular area, considering factors such as crime rates, natural disasters, and even the local economy. For instance, regions prone to hurricanes, tornadoes, or wildfires often see higher insurance premiums due to the increased risk of claims.

| Region | Average Annual Premium |

|---|---|

| South Atlantic Region | $2,100 |

| West South Central Region | $1,850 |

| East North Central Region | $1,650 |

In a recent survey conducted by the Insurance Information Institute, it was found that the South Atlantic region, which includes states like Florida and South Carolina, had the highest average annual premium at $2,100. This is largely due to the region's vulnerability to hurricanes and tropical storms. On the other hand, the East North Central region, which includes states like Michigan and Ohio, had a lower average premium of $1,650, indicating a lower perceived risk in this area.

Property Value and Age: A Key Determinant

The value and age of a property are fundamental factors in calculating home insurance prices. Older homes, particularly those with outdated electrical systems or plumbing, may pose higher risks and therefore command higher insurance premiums. Similarly, the replacement cost of a property, which is influenced by its value, is a critical consideration for insurers.

| Property Age | Average Premium Increase |

|---|---|

| Over 50 years | +15% |

| 30–50 years | +10% |

| 10–30 years | +5% |

According to a study by the National Association of Insurance Commissioners, older properties often require higher premiums due to the increased likelihood of structural issues and the higher costs associated with modern building standards. For instance, a home over 50 years old may see a premium increase of up to 15% compared to a newly constructed property.

Coverage Options and Limits: Customizing Your Policy

Homeowners have the flexibility to tailor their insurance policies to meet their specific needs. The chosen coverage options and limits significantly impact the overall cost. For example, increasing the liability coverage limit or adding endorsements for valuable possessions can drive up the premium. On the other hand, selecting a higher deductible can reduce the premium, but it also means the homeowner will pay more out-of-pocket in the event of a claim.

Expert Strategies for Securing the Best Home Insurance Deal

With a comprehensive understanding of the factors influencing home insurance prices, homeowners can employ strategic approaches to secure the most cost-effective coverage. Here are some expert tips to navigate the home insurance market and find the best deal.

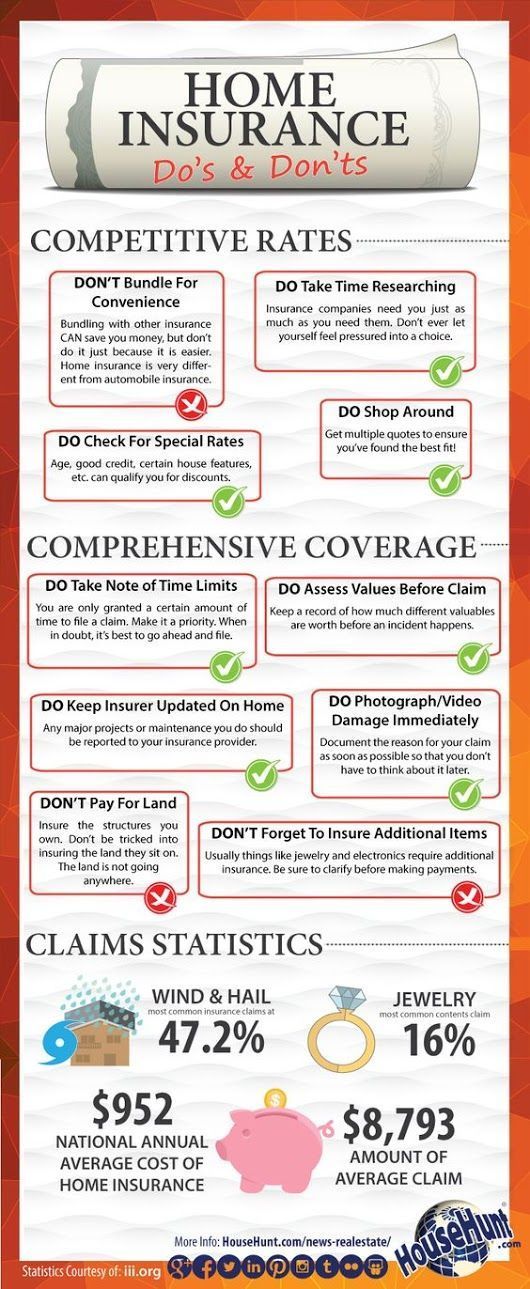

Shop Around and Compare Quotes

The home insurance market is highly competitive, and insurers offer a wide range of policies and premiums. Shopping around and comparing quotes is essential to finding the best value. Online comparison tools can provide a quick and efficient way to view multiple quotes, allowing homeowners to make informed decisions.

Consider using independent insurance agents who can provide quotes from multiple insurers. They can offer personalized advice and help tailor a policy to your specific needs. It's also beneficial to periodically review your policy and shop around for better rates, especially during significant life changes like moving to a new home or making substantial improvements to your current property.

Bundle Your Policies for Discounts

Many insurance companies offer discounts when you bundle multiple policies with them. This could mean combining your home insurance with auto, life, or other types of insurance. By bundling, you not only save on premiums but also streamline your insurance management, often with the added benefit of having a single point of contact for all your insurance needs.

Explore Discounts and Savings Opportunities

Insurance providers offer various discounts to attract and retain customers. These discounts can significantly reduce your premium. Some common discounts include:

- Safety Features Discounts: Installing security systems, smoke detectors, or fire suppression systems can qualify you for discounts. These features reduce the risk of theft and damage, making you a lower-risk client for insurers.

- Loyalty Discounts: Many insurers reward long-term customers with loyalty discounts. Staying with the same insurer for multiple years can lead to substantial savings over time.

- Payment Method Discounts: Paying your premium in full or opting for electronic payments can sometimes result in small discounts, as it reduces administrative costs for the insurer.

Understand Your Deductibles and Coverage Limits

Deductibles and coverage limits are critical aspects of your home insurance policy. A higher deductible means you’ll pay more out-of-pocket in the event of a claim, but it can significantly reduce your premium. On the other hand, lower deductibles provide more financial protection but come with higher premiums.

Similarly, understanding your coverage limits is essential. Most policies have limits on certain types of coverage, such as personal property or liability. Ensure that these limits align with your needs and the value of your possessions. If you have high-value items, consider adding an endorsement or rider to your policy to ensure they're adequately covered.

The Future of Home Insurance Pricing

The home insurance market is evolving, and several trends are shaping the future of pricing. From technological advancements to changing consumer preferences, insurers are adapting to stay competitive and offer the best value to homeowners.

Technology and Data Analytics

Advancements in technology and data analytics are transforming the insurance industry. Insurers are now able to collect and analyze vast amounts of data to more accurately assess risks and price policies. This includes using satellite imagery to assess property conditions and utilizing artificial intelligence to predict potential risks.

For instance, some insurers are using drone technology to conduct property inspections, providing a faster and more accurate assessment of a property's condition. This technology not only helps insurers price policies more accurately but also offers homeowners a quicker claims process.

Personalized Pricing and Usage-Based Policies

The concept of personalized pricing, also known as usage-based insurance, is gaining traction in the home insurance market. This approach allows insurers to tailor premiums based on an individual’s specific needs and behaviors. By using smart home devices and sensors, insurers can monitor and assess factors like energy usage, water consumption, and even the frequency of door and window openings.

This level of detail allows insurers to offer more precise pricing, rewarding homeowners who take proactive steps to reduce risks. For example, a homeowner who consistently maintains a low energy usage and has a robust security system may qualify for lower premiums.

Changing Consumer Preferences and the Rise of Digital Insurance

The digital age has brought about a shift in consumer preferences, with many homeowners now opting for online insurance services. Digital insurance platforms offer convenience, allowing homeowners to manage their policies, file claims, and make payments online. This shift towards digital insurance is expected to continue, with insurers investing in technology to enhance the customer experience.

Additionally, the rise of digital insurance has led to increased competition, driving insurers to offer more competitive prices and innovative coverage options. This trend benefits homeowners, providing them with a wider range of choices and better value for their insurance needs.

How often should I review my home insurance policy?

+It’s recommended to review your home insurance policy annually, especially after significant life events like moving, remodeling, or purchasing high-value items. Regular reviews ensure your coverage remains adequate and allow you to take advantage of any new discounts or policy enhancements.

Can I negotiate my home insurance premium?

+While insurance premiums are typically non-negotiable, you can discuss your policy with your insurer to understand how certain factors influence your premium. This dialogue can help you make informed decisions about your coverage and potentially identify areas where you can save money.

What should I do if I’m unsure about the coverage limits in my policy?

+If you have questions about your coverage limits, reach out to your insurance agent or company. They can provide detailed explanations and guidance to ensure you have the right level of coverage for your needs. It’s essential to understand your policy to avoid any surprises in the event of a claim.