Hire Top General Liability

When it comes to safeguarding your business and managing potential risks, obtaining adequate insurance coverage is paramount. General liability insurance is a cornerstone of any comprehensive risk management strategy, providing protection against a range of liabilities that businesses may face. In this in-depth article, we will explore the intricacies of hiring top-notch general liability insurance, offering expert insights and a thorough analysis to guide you in making informed decisions for your business.

Understanding General Liability Insurance

General liability insurance, often referred to as commercial general liability (CGL), is a vital component of a business’s insurance portfolio. It is designed to protect businesses from a wide array of potential liabilities, including bodily injury, property damage, personal and advertising injury, and medical expenses. This type of insurance serves as a safety net, helping businesses mitigate the financial risks associated with lawsuits and claims arising from everyday operations.

Key Coverage Areas

General liability insurance covers a broad spectrum of risks, including but not limited to:

- Bodily Injury: This coverage protects against claims arising from accidents or injuries that occur on your business premises or as a result of your products or services.

- Property Damage: In the event that your business activities cause damage to someone else’s property, this coverage steps in to provide financial protection.

- Personal and Advertising Injury: This aspect of general liability covers claims related to libel, slander, copyright infringement, and other similar offenses.

- Medical Expenses: General liability insurance often includes coverage for medical expenses incurred by third parties due to accidents on your business premises.

The Importance of Top-Tier General Liability

Hiring top-tier general liability insurance is a strategic decision that can significantly impact your business’s financial health and stability. Here’s why it matters:

Comprehensive Risk Management

Top-notch general liability insurance policies offer comprehensive coverage tailored to your business’s unique needs. By assessing your specific risks and vulnerabilities, these policies ensure that you are adequately protected against a wide range of potential liabilities.

Financial Protection

The financial consequences of lawsuits and claims can be devastating for any business. Hiring premium general liability insurance provides a robust financial safety net, ensuring that your business can withstand the financial burden of legal proceedings and potential damages.

Peace of Mind

Knowing that you have top-tier general liability coverage in place can bring peace of mind to business owners and stakeholders. It allows you to focus on your core operations and growth strategies without constant worry about unforeseen liabilities.

Key Considerations When Hiring General Liability

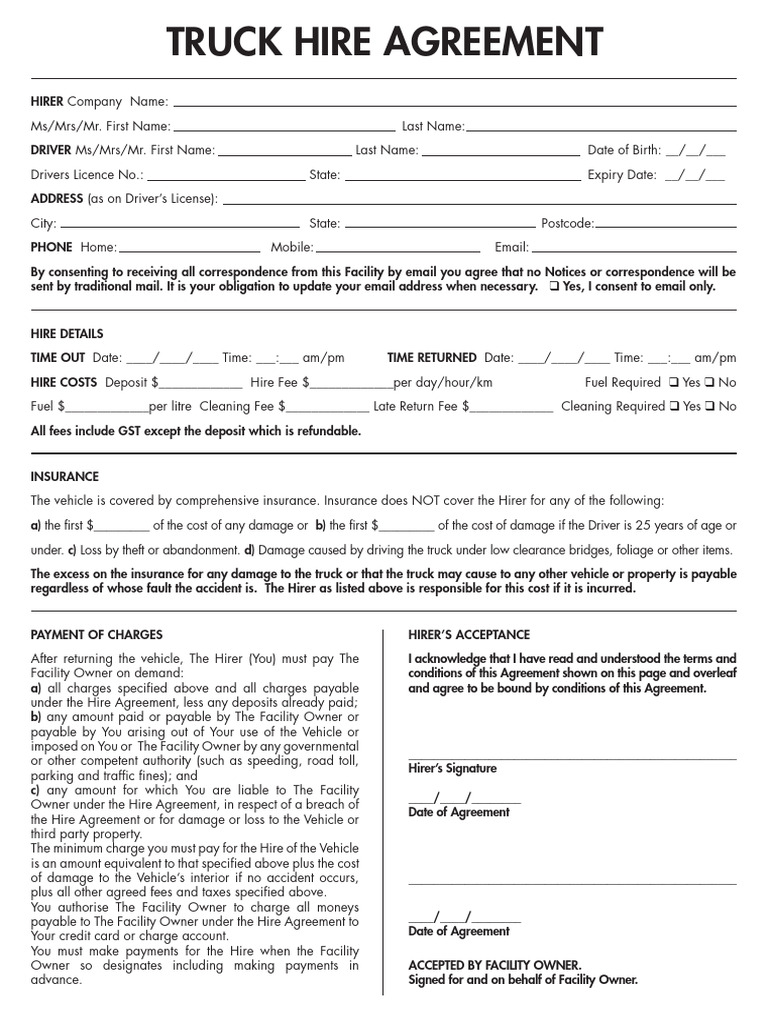

When embarking on the journey of hiring general liability insurance, several critical factors come into play. These considerations will shape your decision-making process and help you secure the best coverage for your business.

Assessing Your Business Risks

Every business operates in a unique environment with its own set of risks. Before selecting a general liability policy, conduct a thorough assessment of your business’s specific risks. Consider factors such as the nature of your industry, the products or services you offer, your customer base, and any unique hazards associated with your operations.

Coverage Limits

General liability insurance policies come with coverage limits, which specify the maximum amount the insurer will pay out for a covered claim. It’s essential to choose coverage limits that align with your business’s financial capacity and potential liabilities. Consult with insurance experts to determine the appropriate limits for your business.

Policy Exclusions

While general liability insurance offers broad coverage, it also comes with exclusions—situations or liabilities that are not covered by the policy. Carefully review the exclusions listed in the policy to ensure that your business’s critical areas of risk are adequately protected.

Claims Handling and Customer Service

The effectiveness of your general liability insurance extends beyond the coverage itself. Consider the insurer’s reputation for efficient claims handling and customer service. In the event of a claim, you want to work with a provider that offers prompt and professional assistance to guide you through the process.

Comparative Analysis: Top General Liability Providers

The market for general liability insurance is diverse, with numerous providers offering a range of policies. Conducting a comparative analysis is crucial to identify the top providers that align with your business’s needs.

Provider Reputation and Financial Stability

Start by evaluating the reputation and financial stability of potential providers. Look for insurers with a solid track record of paying claims and maintaining strong financial ratings. A stable insurer ensures that your coverage remains secure over the long term.

Policy Features and Customization

Examine the policy features offered by different providers. Top-tier general liability policies often provide customizable options, allowing you to tailor the coverage to your business’s specific needs. Assess whether the provider offers additional endorsements or riders to enhance your protection.

Cost and Value

While cost is an essential consideration, it should not be the sole factor in your decision-making process. Compare the premiums offered by different providers, but also evaluate the value proposition. A slightly higher premium with more comprehensive coverage and better service may be a wiser choice in the long run.

| Provider | Premium (Annual) | Coverage Limits | Policy Features |

|---|---|---|---|

| Insurer A | $1,200 | $2,000,000 | Customizable endorsements, excellent claims handling |

| Insurer B | $1,150 | $1,500,000 | Standard coverage, good customer service |

| Insurer C | $1,350 | $2,500,000 | Comprehensive coverage, excellent financial ratings |

Expert Tips for Hiring Top General Liability

As an expert in the field, here are some invaluable tips to help you navigate the process of hiring top-tier general liability insurance:

Work with an Insurance Broker

Engaging the services of a reputable insurance broker can be immensely beneficial. Brokers have extensive knowledge of the insurance market and can guide you through the complex process of selecting the right policy. They can negotiate on your behalf and ensure that your business’s interests are protected.

Review Policies Annually

General liability insurance is not a one-time purchase. Regularly review your policy, ideally on an annual basis, to ensure that it continues to meet your evolving business needs. As your business grows and changes, so do your risks, and your insurance coverage should reflect these shifts.

Understand Policy Wording

Take the time to thoroughly understand the wording and terminology used in your general liability policy. This ensures that you are fully aware of the coverage you have and the exclusions that may apply. If any terms are unclear, consult with your insurance broker or seek clarification from the insurer.

Maintain a Good Claims History

Insurers often reward businesses with a good claims history by offering more favorable terms and premiums. Strive to maintain a positive claims record by implementing robust risk management practices and taking proactive measures to prevent accidents and incidents.

Future Implications and Industry Trends

The landscape of general liability insurance is dynamic, influenced by evolving business practices, regulatory changes, and emerging risks. Staying abreast of industry trends and future implications is essential for business owners and risk managers.

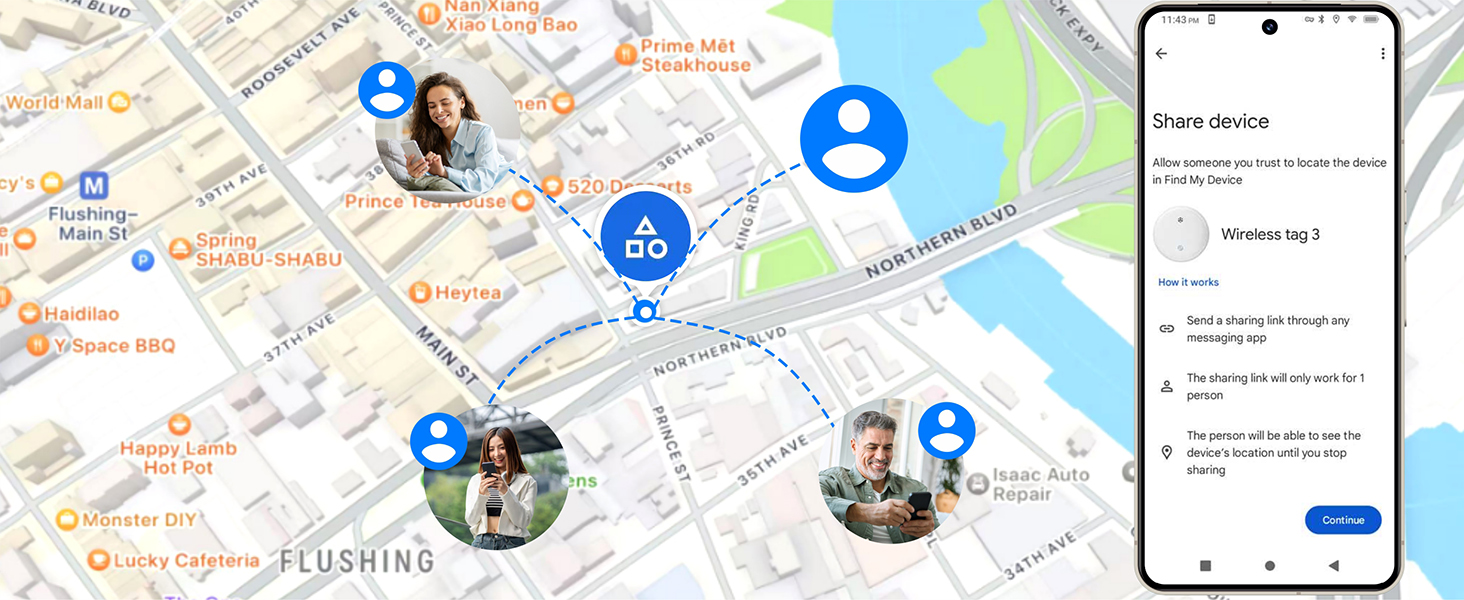

Emerging Risks and Coverage Gaps

As technology advances and business models evolve, new risks emerge. For instance, with the increasing reliance on digital technologies, cyber liability risks have become a significant concern for many businesses. Stay informed about emerging risks and consider whether your general liability policy provides adequate coverage for these new challenges.

Regulatory Changes

Regulatory bodies often introduce new laws and regulations that impact the insurance industry. Stay updated on any changes that may affect your business’s liability exposure. For example, changes in product safety regulations or environmental standards could have implications for your general liability coverage.

Industry Innovation

The insurance industry is continually innovating, introducing new products and services to meet the evolving needs of businesses. Keep an eye on industry innovations, such as parametric insurance or innovative risk transfer mechanisms, which may offer more efficient and effective ways to manage your business’s liabilities.

Conclusion: Navigating the Complex World of General Liability

Hiring top-tier general liability insurance is a strategic decision that requires careful consideration and expert guidance. By understanding the intricacies of general liability coverage, assessing your business’s unique risks, and working with reputable insurance providers, you can secure the protection your business needs to thrive. Remember, general liability insurance is not just a financial safety net; it’s a cornerstone of your business’s overall risk management strategy.

How often should I review my general liability insurance policy?

+It is recommended to review your general liability insurance policy annually or whenever significant changes occur in your business operations or risk profile. Regular reviews ensure that your coverage remains aligned with your evolving needs.

What are some common exclusions in general liability policies?

+Common exclusions in general liability policies may include intentional acts, pollution, contract-related liabilities, and professional services. It’s essential to carefully review the policy’s exclusions to understand the limitations of your coverage.

Can I customize my general liability policy to include specific coverage?

+Yes, many insurers offer customizable options and endorsements to tailor your general liability policy to your business’s unique needs. Discuss your specific requirements with your insurance broker to explore the available customization options.