Affordable Motorcycle Insurance

Motorcycle insurance is an essential aspect of responsible riding, ensuring financial protection and peace of mind for riders. However, finding affordable coverage that suits your needs can be a challenging task. This comprehensive guide aims to explore the world of motorcycle insurance, offering valuable insights, expert advice, and real-world examples to help you navigate the process effectively.

Understanding Motorcycle Insurance Coverage

Motorcycle insurance provides financial coverage in case of accidents, theft, or other unforeseen events. It protects riders and their vehicles, covering a range of scenarios and potential liabilities. Understanding the different types of coverage is crucial to making an informed decision about your policy.

Liability Coverage

Liability coverage is a fundamental aspect of motorcycle insurance. It protects riders from claims made by others involved in an accident, covering bodily injury and property damage costs. This coverage is mandatory in most states and is essential for riders to meet legal requirements.

For instance, consider a scenario where a motorcycle rider collides with a car at an intersection. If the rider is at fault, liability coverage would pay for the medical expenses and vehicle repairs of the car driver and passengers. This coverage ensures the rider's financial responsibility and protects them from potentially devastating costs.

| Liability Coverage | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses and lost wages of others injured in an accident. |

| Property Damage Liability | Pays for repairs or replacement of damaged property, such as vehicles or structures. |

Comprehensive and Collision Coverage

Comprehensive and collision coverage offers protection for your motorcycle against damage or loss caused by events other than collisions, such as theft, vandalism, natural disasters, or accidents with animals. Collision coverage, on the other hand, specifically covers damage resulting from collisions with other vehicles or objects.

Let's say a rider's motorcycle is stolen from their garage. Comprehensive coverage would reimburse the rider for the value of the stolen bike, ensuring they aren't left with a financial burden. Similarly, if a rider hits a deer while riding, collision coverage would cover the repairs needed for the motorcycle.

| Coverage Type | Description |

|---|---|

| Comprehensive Coverage | Protects against non-collision incidents like theft, fire, and natural disasters. |

| Collision Coverage | Covers damage caused by collisions with other vehicles or objects. |

Medical Payments and Personal Injury Protection (PIP)

Medical payments and PIP coverage provide reimbursement for medical expenses incurred by the insured rider and their passengers in the event of an accident, regardless of fault. This coverage is particularly valuable as it ensures quick access to medical care without waiting for liability claims to be settled.

Imagine a rider involved in an accident sustains injuries requiring immediate medical attention. Medical payments coverage would provide financial assistance for these expenses, covering hospital stays, surgeries, and rehabilitation costs.

| Coverage Type | Description |

|---|---|

| Medical Payments Coverage | Covers medical expenses for the insured rider and passengers. |

| Personal Injury Protection (PIP) | Provides broader coverage, including medical expenses, lost wages, and funeral costs. |

Factors Affecting Motorcycle Insurance Costs

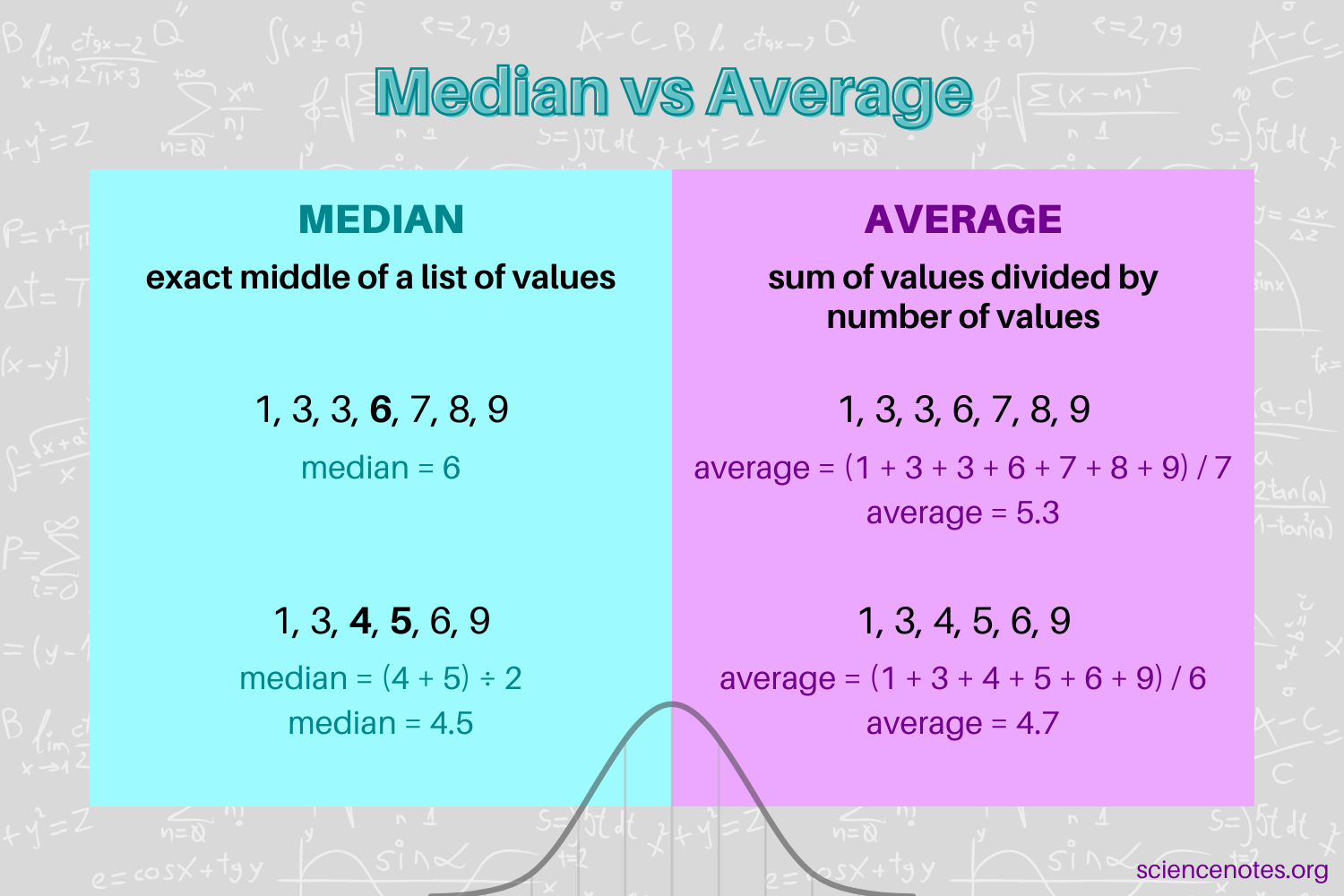

The cost of motorcycle insurance can vary significantly based on several factors. Understanding these factors can help riders make informed decisions to find affordable coverage that suits their needs.

Rider's Profile and History

Insurance providers consider the rider's age, gender, riding experience, and driving record when calculating insurance premiums. Younger riders and those with a history of accidents or violations may face higher premiums. Conversely, experienced riders with a clean driving record often enjoy lower rates.

For example, a 25-year-old rider with a history of speeding tickets and accidents may pay significantly more for insurance compared to a 40-year-old rider with a clean driving record and extensive riding experience.

Type of Motorcycle

The type of motorcycle being insured plays a crucial role in determining insurance costs. Sports bikes and high-performance motorcycles generally carry higher insurance premiums due to their increased risk of accidents and theft. Conversely, standard motorcycles and scooters often have lower insurance costs.

Consider a comparison between a powerful sports bike and a classic cruiser. The sports bike, known for its speed and agility, may attract higher insurance premiums due to its association with higher-risk riding. In contrast, the classic cruiser, with its relaxed riding style, may be insured at a more affordable rate.

Coverage and Deductibles

The level of coverage chosen and the associated deductibles significantly impact insurance costs. Opting for higher coverage limits and lower deductibles typically results in higher premiums. Conversely, choosing lower coverage limits and higher deductibles can reduce insurance costs.

A rider choosing comprehensive coverage with a $500 deductible may pay a higher premium compared to a rider selecting basic liability coverage with a $1,000 deductible. The choice between these options depends on the rider's risk tolerance and financial preferences.

Tips for Finding Affordable Motorcycle Insurance

Navigating the motorcycle insurance landscape to find affordable coverage can be challenging. Here are some expert tips to help riders make informed decisions and secure the best insurance rates:

Shop Around and Compare Quotes

Insurance rates can vary significantly between providers. Shopping around and comparing quotes from multiple insurers is essential to finding the best deal. Online quote comparison tools can provide a quick and convenient way to compare rates and coverage options.

Consider using an insurance broker who can shop multiple insurers on your behalf. Brokers have access to a wide range of insurance companies and can negotiate the best rates for their clients.

Bundle Insurance Policies

Bundling your motorcycle insurance with other insurance policies, such as auto or home insurance, can often result in significant discounts. Many insurance providers offer multi-policy discounts, so it's worth exploring this option to save on insurance costs.

For instance, if you already have auto insurance with a particular provider, inquire about discounts for adding motorcycle insurance to your existing policy. Bundling insurance policies can lead to substantial savings.

Increase Deductibles and Reduce Coverage

Increasing your deductible and reducing coverage limits can lower your insurance premiums. However, it's essential to strike a balance between affordability and adequate coverage. Ensure you still have sufficient coverage to protect your assets and meet legal requirements.

Consider your financial situation and risk tolerance when making these decisions. While increasing deductibles can save on premiums, it also means you'll pay more out of pocket in the event of a claim.

Take Advantage of Discounts

Insurance providers offer various discounts to attract and retain customers. These discounts can significantly reduce insurance costs. Some common discounts include safe rider discounts for completing approved safety courses, loyalty discounts for long-term customers, and multi-bike discounts for insuring multiple motorcycles.

Explore the discounts offered by your insurance provider and see if you're eligible for any of them. Taking advantage of these discounts can lead to substantial savings on your insurance premiums.

Real-World Examples of Affordable Motorcycle Insurance

Let's explore some real-world examples of affordable motorcycle insurance policies to illustrate the range of options available to riders:

Basic Liability Coverage for a Commuter Rider

A commuter rider who primarily uses their motorcycle for short trips to work or nearby errands may opt for basic liability coverage. This coverage provides the necessary legal protection while keeping insurance costs low.

For instance, a rider in their mid-30s with a clean driving record and a standard motorcycle might pay around $300 annually for basic liability coverage. This coverage ensures they meet legal requirements and provides financial protection in case of an accident.

Comprehensive Coverage for a Weekend Warrior

A rider who enjoys weekend rides and longer trips may opt for comprehensive coverage to protect their motorcycle and themselves. This coverage provides peace of mind and financial security for riders who invest more time and resources into their riding hobby.

Consider a weekend warrior rider in their early 40s with a sports bike. By choosing comprehensive coverage with a $500 deductible, they may pay around $600 annually. This coverage ensures their motorcycle is protected against theft, vandalism, and accidents, providing the rider with the necessary financial backup to enjoy their riding adventures.

Full Coverage for a Daily Rider

A daily rider who relies on their motorcycle for commuting and running daily errands may opt for full coverage to protect their vehicle and themselves. Full coverage typically includes liability, comprehensive, and collision coverage, providing comprehensive protection.

For example, a daily rider in their late 20s with a standard motorcycle and a clean driving record might pay around $1,000 annually for full coverage. This coverage ensures their motorcycle is protected against various risks and provides financial security in case of accidents or other incidents.

Future Implications and Industry Trends

The motorcycle insurance industry is continuously evolving, and several trends and developments are shaping the future of insurance coverage for riders. Understanding these implications can help riders make informed decisions and adapt to the changing landscape.

Advancements in Telematics and Usage-Based Insurance

Telematics technology, which uses data transmission to track and record driving behavior, is gaining traction in the insurance industry. Usage-based insurance, or pay-as-you-ride insurance, is a growing trend that uses telematics to offer insurance premiums based on actual driving behavior and mileage.

Insurance providers using telematics can offer personalized insurance rates based on a rider's driving habits, such as speed, braking, and cornering. This technology encourages safer riding practices and provides riders with the opportunity to lower their insurance premiums by demonstrating responsible behavior.

Increased Focus on Rider Safety and Education

The motorcycle insurance industry is placing a growing emphasis on rider safety and education. Insurance providers are offering incentives and discounts to riders who complete approved safety courses and demonstrate a commitment to safe riding practices.

By investing in rider safety and education, insurance providers aim to reduce accident rates and claims, leading to lower insurance costs for responsible riders. This trend not only benefits riders financially but also contributes to a safer riding community.

Integration of Advanced Motorcycle Technologies

The development and integration of advanced motorcycle technologies, such as anti-lock braking systems (ABS), traction control, and collision avoidance systems, are shaping the future of motorcycle insurance. These technologies enhance rider safety and reduce the risk of accidents, leading to potential insurance premium reductions.

Insurance providers are recognizing the safety benefits of these advanced technologies and offering discounts or reduced premiums for motorcycles equipped with such features. As these technologies become more prevalent, we can expect insurance providers to continue adjusting their rates to reflect the reduced risk associated with these advancements.

Frequently Asked Questions (FAQ)

How do I choose the right motorcycle insurance coverage for my needs?

+

Choosing the right motorcycle insurance coverage involves considering your riding habits, the value of your bike, and your personal financial situation. Assess your needs and risks, and opt for coverage that provides adequate protection without excessive costs. Consider liability, comprehensive, and collision coverage, and customize your policy to meet your specific requirements.

What factors can I control to reduce my motorcycle insurance costs?

+

You can control several factors to reduce your motorcycle insurance costs. These include maintaining a clean driving record, taking approved safety courses to earn discounts, and shopping around for the best rates. Additionally, consider bundling your insurance policies and taking advantage of any available discounts to further reduce your premiums.

Are there any insurance discounts specifically for motorcycle riders?

+

Yes, insurance providers often offer discounts specifically for motorcycle riders. These can include safe rider discounts for completing approved safety courses, multi-bike discounts for insuring multiple motorcycles, and loyalty discounts for long-term customers. It’s worth exploring these options to save on your insurance premiums.

How does my riding experience impact my motorcycle insurance rates?

+

Insurance providers consider riding experience when calculating insurance rates. Generally, riders with more experience and a clean driving record tend to receive lower insurance premiums. Younger riders or those with a history of accidents or violations may face higher rates due to the increased risk associated with their riding history.

What should I consider when choosing a deductible for my motorcycle insurance policy?

+

When choosing a deductible, consider your financial situation and risk tolerance. A higher deductible can lower your insurance premiums, but it also means you’ll pay more out of pocket in the event of a claim. Assess your ability to cover the deductible amount and choose a level that provides a balance between affordability and adequate protection.